You should buy a property that wont take anything more than 28 percent of your gross monthly income. Thats because annual salary isnt the only variable that.

What House Can We Afford Outlet 51 Off Www Ingeniovirtual Com

Use this calculator to calculate how expensive of a home you can afford if you have 110k in annual income.

. The front-end debt ratio is also known as the mortgage-to-income ratio and is computed by dividing total monthly housing costs by monthly gross income. Your debt-to-income ratio DTI credit score down payment and interest rate all factor into what you can afford. A 500 car payment can reduce your buying power by.

If you make around 100000 the utmost price you would be able to pay would be approximately 300000 depending on your situation. A basic rule of thumb when attempting to calculate how much mortgage you can afford is to multiply your salary by at least 25 or 3 to obtain an idea of the maximum house price you can afford. Simple Mortgage Payment Calculator.

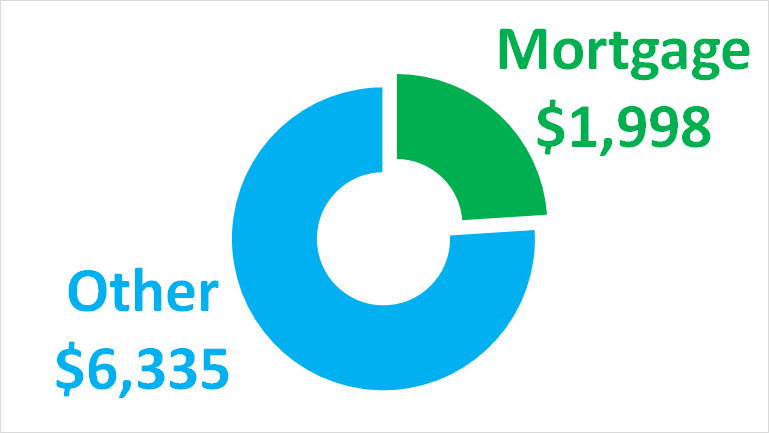

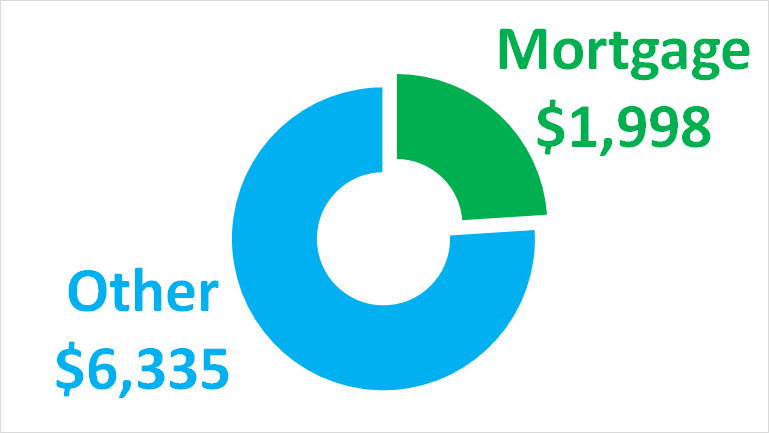

If you earn approximately 100000 the maximum price you would be able to afford would be roughly 300000. When attempting to determine how much mortgage you can afford a general guideline is to multiply your income by at least 25 or 3 to get an idea of the maximum housing price you can afford. This is what you can afford in 453775 Your monthly payment 2500.

Using a 45 percent interest rate and a 30-year term this translates into 1267 monthly which equals 456017 over 30 years. Experts suggest you might need an annual income between 100000 to 225000 depending on your financial profile in order to afford a 1 million home. Affordability Calculator See how much house you can afford with our easy-to-use calculator.

You want to keep your debt payments as low as possible. If you take 30 of 100000 you will get 30000. How much house can I afford if I make 200K per year.

Your budget and financial situation will determine how much you can afford on a 100k salary but in most cases youll likely qualify for a home worth between 350000 to 500000. The above table gives an estimate of how much house individuals with a 100k annual income in Texas can afford. This means that if you make 100000 a year you should be able to afford 2500 per month in rent.

House Max Budget. Like the inaugural two home buyers they earn 100k a year. If youre wondering with 100k salary how much house can I afford the 25 rule gives you a mortgage of 250000.

If you have a 20 down payment on a 100000 household salary you can probably comfortably afford a 560000 condo. Financial Home Home Equity Calculator Mortgage Payment Rent versus Buy Calculator Simple Mortgage Payment Calculator Annual Income Monthly Debt Cash in hand for down payment Property tax rate Home Insurance rate Interest Rate Length of Loan years. Simply take your gross income and multiply it by 25 or 3 to get the maximum value of the home you can afford.

You can easily calculate yours using the Home Affordability Calculator Zillow. How much home can I afford if I make 110000. Buying a house with a 100K salary and good credit Our second borrower also makes 100k a year.

New home construction for a 2000 square foot home runs 201000 to 310000 on average. If youre wondering with 100k salary how much house can I afford the 25 rule gives you a mortgage of 250000. 1866 650 x 100000 290000 their maximum mortgage amount Ideally you have a down payment of at least 10 and.

For example if you earned 100000 a year it would be no more than 2333 a month. As a rule of thumb a person who makes 50000 a year might be able to afford a house worth anywhere from 180000 to nearly 300000. If youre wondering with 100k salary how much house can I afford the 25 rule gives you a mortgage of 250000.

For a 250000 home a down payment of 3 is 7500 and a down payment of 20 is 50000. Your budget and financial situation will determine how much you can afford on a 100k salary but in most cases youll likely qualify for a home worth between 350000 to 500000. That means two people who each make 100000 per year but have different credit scores debt.

The amount you can borrow for a mortgage depends on many variables and income is just one of them. What is the monthly payment on a 100k mortgage. How much house can I afford if I make 100k a year.

The most common rule for deciding if you can afford a home is the 28 percent one though many are out there. Another rule of thumb is the 30 rule. Typically youll pay around 3 to 5 of a homes value in closing costs.

How much house can I afford if I make 100K per year. When attempting to determine how much mortgage you can afford a general guideline is to multiply your income by at least 25 or 3 to get an idea of. How much house you can afford on 100k also depends on how much debt you currently have including auto loans student loans credit cards and other loans.

Buying a house with a 100K salary and great credit The third base borrower has an excellent credit score of 760. For instance someone with low credit might only be eligible for a 300000 mortgage while someone with excellent credit might qualify for a 500000 mortgage. As a rule of thumb a person who makes 50000 a year might be able to afford a house worth anywhere from 180000 to nearly 300000.

This calculator allows you to calculate the amount you can afford to pay for a mortgage. This is what you can afford in 449484 Your monthly payment 2500 Affordable Stretch Aggressive Your debt-to-income ratio DTI would be 36 meaning 36 of your pretax income would go toward. The value of the home or mortgage you can afford in Texas is dependent on several factors such as down.

For the couple making 80000 per year the Rule of 28 limits their monthly mortgage payments to 1866. Make sure to consider property taxes home insurance and your other debt payments. Using a home loan of 300000 this would be the results based on a fixed rate of 4241 APR.

For our calculator only conventional and FHA loans utilize the front-end debt ratio. This person besides has no debts and is prepared to put down 20 on the home. That means two people who each make 100000 per year but have different credit scores debt.

You should buy a property that wont take anything more than 28 percent of your gross monthly income. A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability. What is the monthly payment of the mortgage loan.

How much can I borrow if I make 100k. How much house can I afford if I make 200K per year. With a salary of 100000 per year how much house can I afford.

I Make 100 000 A Year How Much House Can I Afford Bundle

Mortgage For 100k Top Sellers 57 Off Www Ingeniovirtual Com

How Much House Can I Get With 100k Income Youtube

How Much House Can I Afford In Texas Making 100k A Year Home By Four

How Much House Can I Afford Bhhs Fox Roach

How Much Of A Mortgage Can I Afford Making 150 000 A Year

How Much Mortgage Can I Afford With A 100k Salary Foundation Mortgage

0 comments

Post a Comment